IN THIS LESSON

Bookkeeping refers to the recording of financial records.

This lesson describes the bookkeeping basics, the accounting life cycle, and the different bookkeeping systems.

Lesson Overview

Welcome to lesson two, bookkeeping. According to polls of small business owners, 40 percent (40%) say bookkeeping and taxes are the worst part of owning a business.

Bookkeeping refers to the recording of financial records. This lesson describes the bookkeeping basics, the accounting life cycle, and the different bookkeeping systems.

In this lesson, you will:

Describe the importance of bookkeeping,

Identify the steps in the accounting life cycle, and

Differentiate between the two basic bookkeeping systems.

Bookkeeping Basics

What do you use to keep track of your personal bank transactions? Whether you balance your checkbook by writing down each transaction you make or use an online service provided by your bank, it is vital that you manage your bank account so you don’t end up with a zero balance.

Similarly, good bookkeeping helps to properly manage your business resources. As mentioned earlier in this course, even if you are not planning to do the bookkeeping yourself, you still need to understand the basics so you know where your money is coming and going.

Below are some of the most common bookkeeping basics for a small business:

Revenue and expenses

Cash

Inventory

Accounts receivable and payable

Sales

Purchases

Employees

Owners’ equity

Retained earnings

Keeping Accurate Books

Keeping accurate books should be a business priority because it will help your business in many ways, such as helping you price your products accurately, showing whether you’re making or losing money, knowing your cash flow, both in short and long term, working with bankers and investors, and letting the tax agencies know how you’re doing.

Accounting Life Cycle

An accounting period reflects all the financial activity within a given period, such as quarterly and yearly. At the end of each accounting period, the organization must prepare all financial statements so that investors can compare the results of successive time periods. This section describes the accounting life cycle and how to use it to ensure the accuracy of the financial statements.

Step one of the accounting life cycle is analyzing business transactions. Here, you begin with business transactions, which can include the sale of a product, the purchase of supplies, and rent.

Next, the business transactions are recorded in the appropriate journal in chronological order.

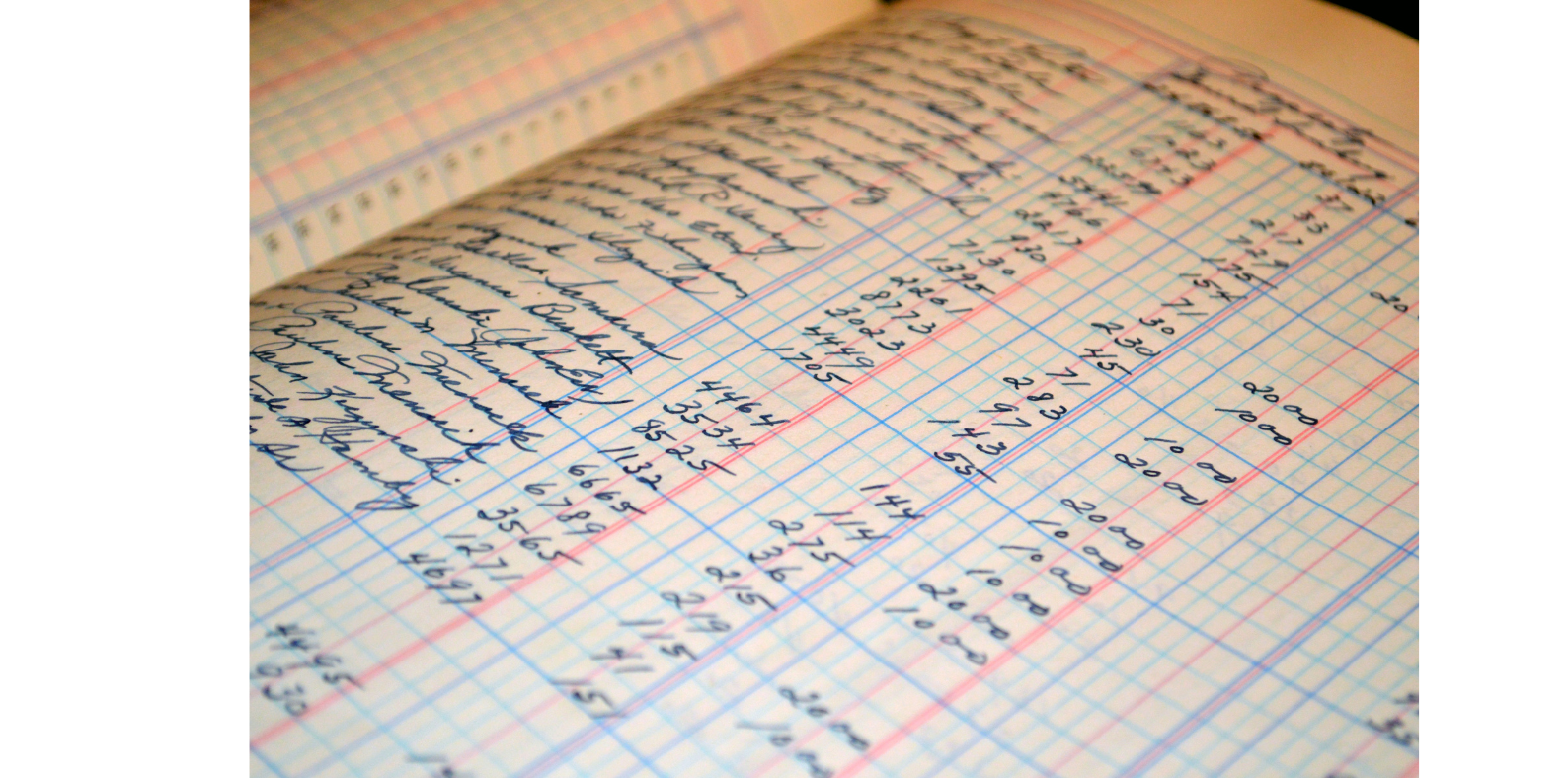

The business transactions are then posted to the general ledger account that it impacts. A general ledger is a moment by moment record of everything that happens in the business.

At the end of the accounting period, monthly, quarterly, or yearly, you should calculate a trial balance. The trial balance assesses the equality of debits and credits as they are recorded in the general ledger. Today, most small businesses use financial software that runs on a computer to keep track of their general ledger.

Sometimes the first trial balance calculation may show that the books are not balanced, so you will need to look for errors and then make adjustments. This may include making adjustments to record an expense that may have been incurred but not yet recorded.

After adjustments are made, you will need to recalculate the trial balance to include any adjustments made to ensure the accounts are balanced.

Once the balances are corrected from the adjusted trial balance, you will then need to prepare the balance sheet and income statement.

Next, the accounts need to be closed out to avoid having revenue or expenses of another period added to the current period.

The last step is to prepare a post-closing trial balance to ensure that all accounts have been closed properly and to test the equality of debit and credit balances of all the balance sheet accounts.

The cycle begins again with all the accounts having zero balances.

Bookkeeping Systems

Bookkeeping systems are used to record your financial transactions and can range from simple to complex as needed depending on your business needs. The two (2) basic bookkeeping systems are single-entry and double-entry.

Single-entry Accounting System

A single-entry accounting system is the simpler of the two. Similar to a personal checking account, it keeps track of what goes in and what goes out of the account. You should only use this system if your business is very small, simple, and with a low volume of activity.

Double-entry Accounting System

A double-entry accounting system is a little more complex than a single-entry system. It tracks the debit and credit for each transaction the business makes. Every debit that is recorded must be matched with a credit. Most businesses use the double-entry accounting system for their accounting needs. Some advantages of using double-entry accounting are that it allows accounting departments to prepare financial statements easily, allows for the recording of assets and liabilities, prevents fraudulent activity by providing checks and balances, and allows you to take advantage of the matching principle.